Examining Market Trends and Anticipating Potential Challenges Amidst Positive Earnings

TLDR:

Despite expectations of a recession, Q1 2023 earnings reports have shown positive surprises in earnings and revenue for many companies

NVIDIA (NVDA) experienced a significant increase in earnings but has seen a decline in its stock since reaching its peak

Tesla (TSLA) had a major increase in stock value but the authors missed out on the full gain and anticipate a cooling off period

Caution that while the market is currently in a Bull market, we anticipate potential cooling down periods for certain stocks and a potential recession in late 2023 or 2024

In the world of finance, the ominous term "recession" has been repeatedly mentioned, leaving investors questioning its arrival. However, recent earnings reports have defied these expectations, painting a different picture. As the first quarter of 2023 concludes, let's explore the market's reaction to positive earnings surprises and assess the potential for future economic challenges.

Positive Earnings Surprises and Stock Market Rally:

During the first quarter, numerous companies reported better-than-expected earnings, defying the anticipated recession. The stock market responded with a rally, further perplexing investors. According to FactSet's data, an impressive 97% of the S&P 500 companies have already released their Q1 2023 results. Among these companies, 78% reported a positive earnings per share, and a staggering 76% exceeded revenue expectations.

NVDA's Strong Performance:

NVIDIA (NVDA), a prominent name in the market, displayed exceptional growth, surprising analysts and investors alike. NVDA witnessed a remarkable 115% increase in earnings from previous periods. This surge can be attributed to its leadership in the field of artificial intelligence, which has been in high demand. However, despite its initial success, NVDA's stock has experienced a decline of approximately 11% from its previous peak. This decline prompts a reassessment of NVDA's future potential, with attention focused on whether the stock will continue its downward trend or stabilize around the $295 range.

Analyzing TSLA's Roller Coaster Ride:

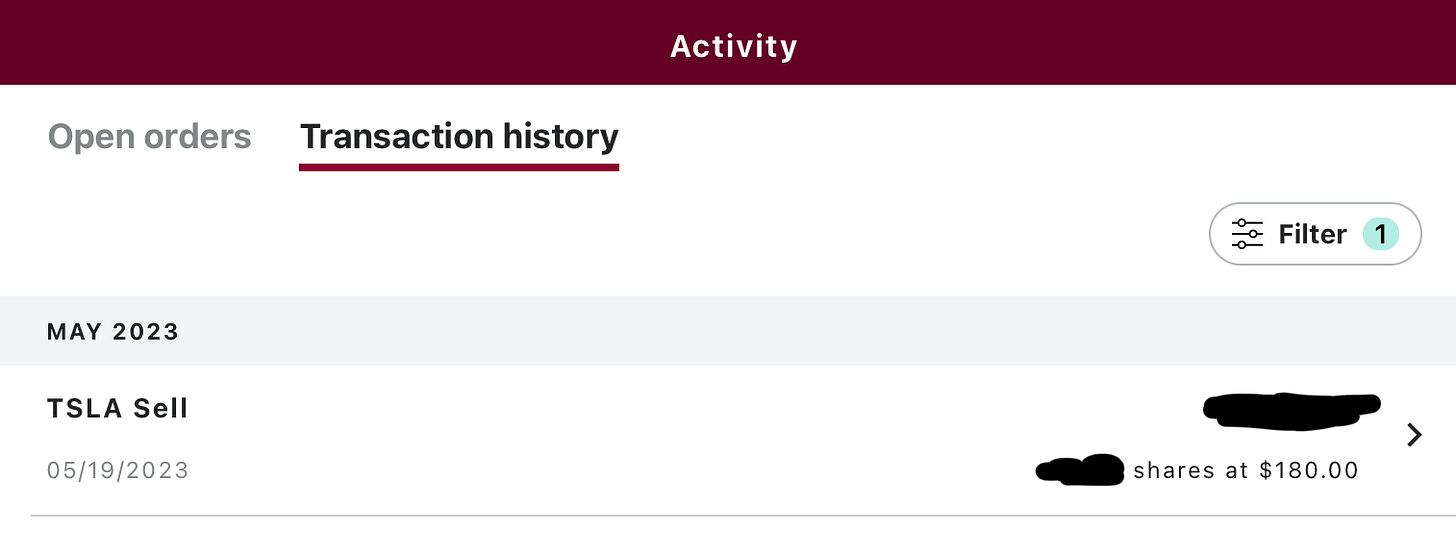

Tesla (TSLA), another influential player in the market, embarked on an impressive journey. Back in February, the article noted a keen interest in TSLA at the $160 price range. Fortunately, the authors seized the opportunity and established an entry at $152. TSLA's stock took off on a massive upward trajectory, soaring from $152 to an astonishing $252, representing a 66% increase in a matter of weeks. Unfortunately, we did not capitalize on the full gain, as we exited at $180, securing an 18% profit. However, recognizing TSLA's historical pattern of running, cooling off, and running again, we anticipate a future cool-off phase around the $270 range. Although some analysts predict TSLA could reach $300, a 100% increase, we want to emphasize the importance of monitoring the stock and reevaluating it as it approaches the $270 level.

Market's Transition to a Bull Market:

A significant milestone was recently achieved in the stock market, specifically in the S&P 500 index. The market surpassed a pivotal level by increasing more than 20% from its bottom trough to its current peak. This surge officially indicates a transition to a Bull market. However, caution is advised when interpreting this shift, as the market's momentum has primarily been concentrated in tech names. Many sectors are yet to experience the same level of growth. Consequently, the authors believe that while certain stocks may begin to cool down, others might start gaining momentum, highlighting the cyclical nature of the market.

Revisiting the "R" Word:

Despite the delayed arrival of a recession, concerns persist regarding the overall macroeconomic landscape. Despite the positive earnings surprises and market rally, there are still shaky grounds to be wary of. Looking ahead, there remains a possibility of a recession towards the end of the year or even in 2024. Investors should keep this in mind as the year progresses, continuing to research and identify opportunities that may arise in the face of changing market conditions.

Conclusion:

The first quarter of 2023 has defied expectations with positive earnings surprises and a thriving stock market. However, caution remains necessary as certain stocks experience declines and the market undergoes cyclical patterns. Investors should be prepared for potential challenges and uncertainties that may arise, including the looming possibility of a recession in the near future. By staying vigilant and adaptive, investors can position themselves to capture the next wave of opportunities in the ever-changing market landscape.

Thank you for being patient with us over the past few weeks. We’ve had a tremendous amount of inquiries asking when the next articles were coming, we took some time to build a road-map of articles which will be dropping on Wednesday’s.

We would your support by sharing our articles with your group of friends, simple click on the button below to share.