Is a Year End Rally In the Making?

TLDR:

Is the possibility of a year-end rally, often referred to as a Santa Claus rally, which has historically seen stock market gains of 5-17% in the past few years in jeopardy?

Recent market performance, with the S&P 500 increasing by 5% at the start of November and strong gains in cryptocurrency assets like Bitcoin and Ethereum in Q4 2023, suggests the potential for another rally

However, there are concerns about a possible pullback, especially after Moody's rating agency downgraded the US debt to negative due to continued political polarization within the government, similar to Fitch's previous downgrade in August

Historical cryptocurrency declines coincided with credit rating downgrades, and the shallow pullbacks in equity markets may limit the chances of a significant year-end rally

If you have been investing for some time or kept up with any of the recent headlines as we come to the end of 2023, there is often a conversation around this time amongst investors about a year end rally. Often dubbed as a Santa Clause rally. In years past, from the start of November through approximately the end of the year, we normally saw the stock market pick up steam. In years past the rally has consisted of gains ranging from approximately 5-17%:

2019: +7%

2020: +17%

2021: +5%

2022: +11%

Will this year be any different or is history looking to repeat itself? Or are there some surprises that may derail the typical Santa Clause rally?

As we continue to analyze the markets, this week alone, the S&5 500 has increased 5% and we are only at the start of November! Is there no pull back in sight?

Even different crypto currency instruments, such as Bitcoin and Ethereum have catapulted in Q4.

Currency November Q4 2023

Bitcoin 9% 41%

Ethereum 16% 28%

Is it time to really jump in and try to capture some of those gains by writing this next wave dub the Santa Claus rally or are we as investors in for a shock and surprise? Late Friday November 10th, after the markets closed, Moody’s rating agency, decreased their rating of the US debt to negative, driving up some concern of another downgrade by a major credit agency. The reasons behind the negative rating as stated by Moody’s was continued political polarization within the government.

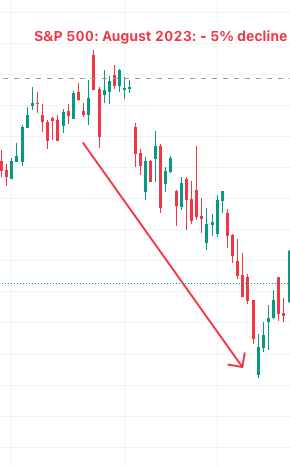

Back in August, credit agency Fitch, decreased their rating of US debt which caused a decline in the markets. During this time the markets fell 5% over the course of the month.

Interestingly, at the time of the Fitch downgrade back in August, Crypto Currency assets also fell. Bitcoin fell 15% and Etherum nearly 18% decline.

The declines in crypto currency had come at the same time of the credit rating but most importantly, came after a massive run and from a peak. With the current Q4 runs from October - early November, this could possibly be a sign of a pullback in the equity markets.

While these pullbacks seem shallow, this leaves little room for a Santa Clause rally as we close this year out. Something we will be watching as we close out the year and capitalize on the direction of the market in the coming weeks.

While it may seem Bulls have been in control, this recent news along with historical data may be a sound indicator of what we may see in the next few weeks as the government attempts to avoid a government shutdown while appeasing their creditors that the US debt is not hindered and has a strong base.

Looking forward reading more in 24 election year analysis