Navigating the Skies of Investment: Unpacking the Potential of the Travel Sector in 2024

Is the Travel Category a sound investment into 2024?

TL;DR:

Analyzing post-Q4 trends in the airline industry for 2024 investments

Boeing and their recent incidents which led to a 13% decrease in their stock value, is there a bounce coming?

Airfare and investment trends are pointing to a positive correlation between current news and where to possibly look to add to a long position within the airline sector

As a new year unfolds and the financial landscape of the last quarter crystallizes, our focus turns to discerning trends that shaped the conclusion of the previous year, particularly in Q4. Amidst the numbers and projections, one sector that beckons attention is the airline industry. The allure of travel, especially during the holiday season from Thanksgiving through Christmas, marks a pivotal period for both airlines and travelers alike. In this exploration, we delve into the trends that unfolded during this peak travel time, analyzing whether they hold the promise of sound investments in the dawn of the new year.

As we step into the new year, the astute investor engages in a strategic dance known as sector rotation. This involves a meticulous reevaluation of portfolios, a shift in focus from once high-flying sectors to emerging opportunities that promise greater potential. With the notable ascent of the Mag 7—(Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA).)—beginning to show signs of a more tempered trajectory, investors find themselves at a crossroads. It's precisely at this juncture that we redirect our attention to sectors and stocks entrenched in our daily lives, shaping not only consumer experiences but also the prospective direction of our investment portfolios.

In the last week, the travel sector began to make news. The Boeing Company ($BA), led the news circuit when an Alaska Airlines flight was forced to make an emergency landing when a door plug fell off the fuselage midair. This is something you normally see in movies and typically unheard of. While the incident occurred at 16,000 feet, it was certainly a devastating experience. This incident single handedly caused the Boeing Company’s stock to plunge almost 13%

The bad news looks like it will continue for the Boeing Company as another flight was forced to land back in Japan due to a cockpit window crack less than a week after the Alaska Airlines incident. With the Federal Aviation Administration increasing its oversight of Boeing production and manufacturing does Boeing have more downside or is it the right time to capture a new wave within this industry?

We do see a little more downside for Boeing but anticipate a bounce relatively soon. While we aren’t actively investing in this holding, buying the dip has proven to be fruitful for investors. We are watching the $208 level to hold for Boeing. Anything under $200 however ought to be treated as sale. Boeing does have some key headwinds into this year, specifically with improving delivery numbers of some of its fleet to China, which hasn’t seen purchases of Boeing planes since 2019. This move alone has a projected future increase in revenue and free cash flow for Boeing as 39% of their 737 MAX dreamliner planes have been set aside for delivery for Chinese customers.

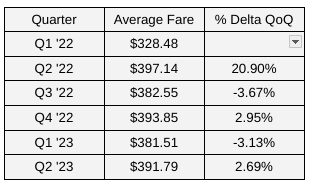

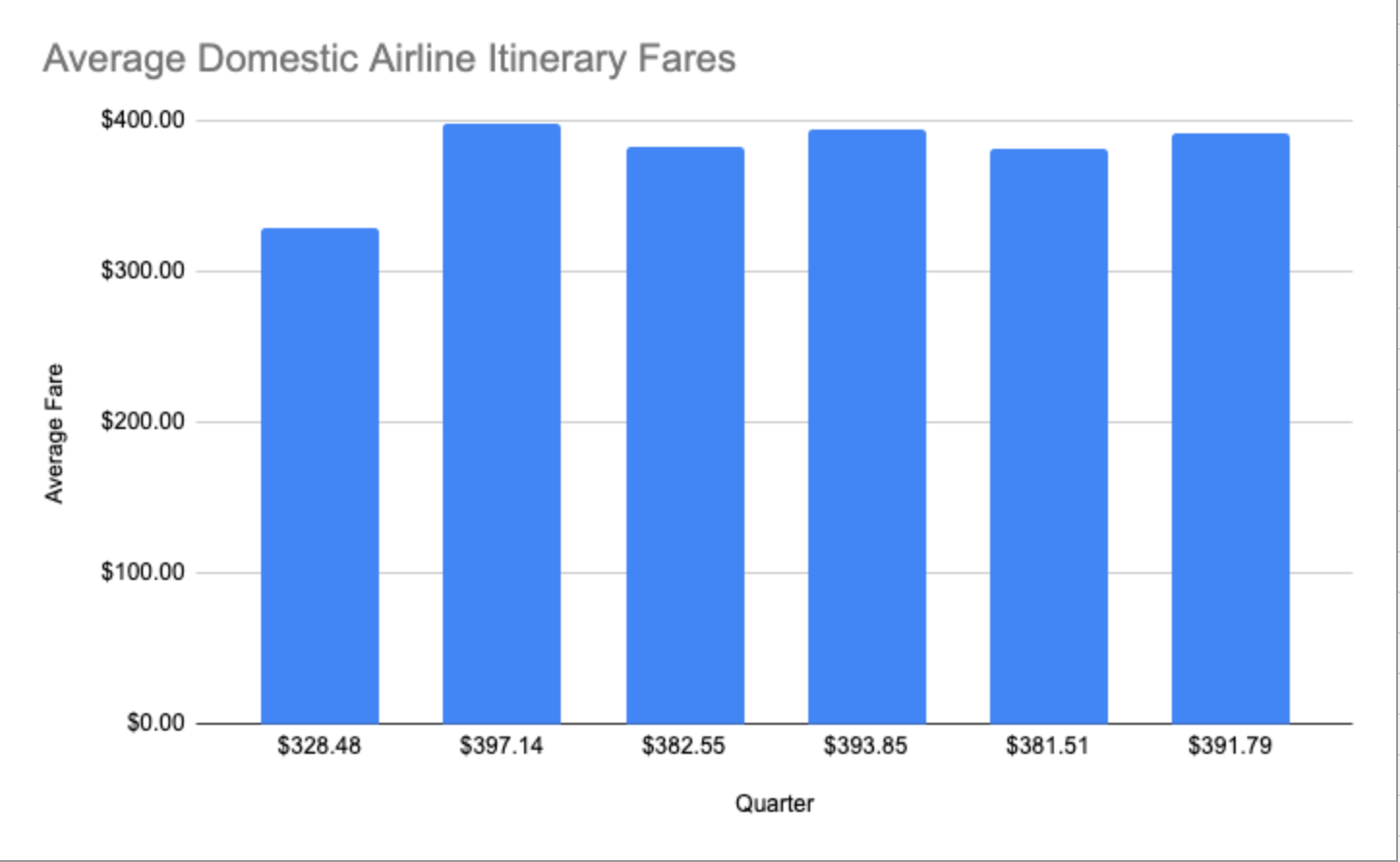

Within actual airline companies, according to the Bureau of Transportation statistics, average airfare seems to only increase quarter over quarter with a decrease in the first quarter and reported increases in the second and fourth quarter of the year. As airfare prices continue to increase, there is no denying airlines and shareholders of such tend to benefit.

As earning’s season kicks off, one of our holdings Delta Airlines ($DAL) reported late last week. Though with less than a stellar future outlook due to earnings falling shy of their long term target. While short term this poses some pressure on the stock price as it fell 9% on earnings release, from a technical analysis level, Delta is screaming a buy. Delta has a strong customer base with a healthy financial position and travel being a top priority for them. Demand for travel remains relatively strong as well which can only help Delta break through existing resistance levels towards possibly $50+ this year. We anticipate a little more downward pressure with an eventual rise out of potential support.

We believe Delta stands in a league of its own with many years of investing in technology, it’s mobile app and other customer experience offerings which other domestic airlines have not matched. With 20% revenue growth and forecasting $3 to $4 billion in cash flow in 2024, we think this is a sector to watch and potentially buy any dips.

Please consult your financial advisor and do your due diligence before making any investments.

If you find this content helpful or have suggestions on investments you’re considering, we’d love to hear from you!

We appreciate any support and interaction with our audience. Please share with your family and friends to help increase our reach.

Insightful take on airline equities and overall commentary on Delta. I think a myriad of factors will likely impact equity prices and airline valuations in the coming years. Specifically, the rise of technology, fuel prices, changes in regulation, and the overall economic recovery from Covid. Consumer confidence will likely play a heavy role on travel demand also. With shaky capital markets and fluctuating interest rates, the longer-term impacts remain to be seen. Nice work on this.

I agree with your assessment on Delta and might consider a larger position