Some tips to save for your child's college education and your own retirement

Recently a colleague asked me a question about how to go about saving for their child’s college education while considering their retirement goals. Being a dad of two, I get asked this question quite often. There is no right or wrong answer, but just ways some people have accomplished saving money for their children and themselves in these tough times.

It is a given, the average price of anything, normally increases year over year. This includes education. On top of that, saving throughout your lifetime has also become challenging in these inflationary times.

Source: Hanson, Melanie. “Average Cost of College & Tuition” EducationData.org, October 24, 2022,

https://educationdata.org/average-cost-of-college

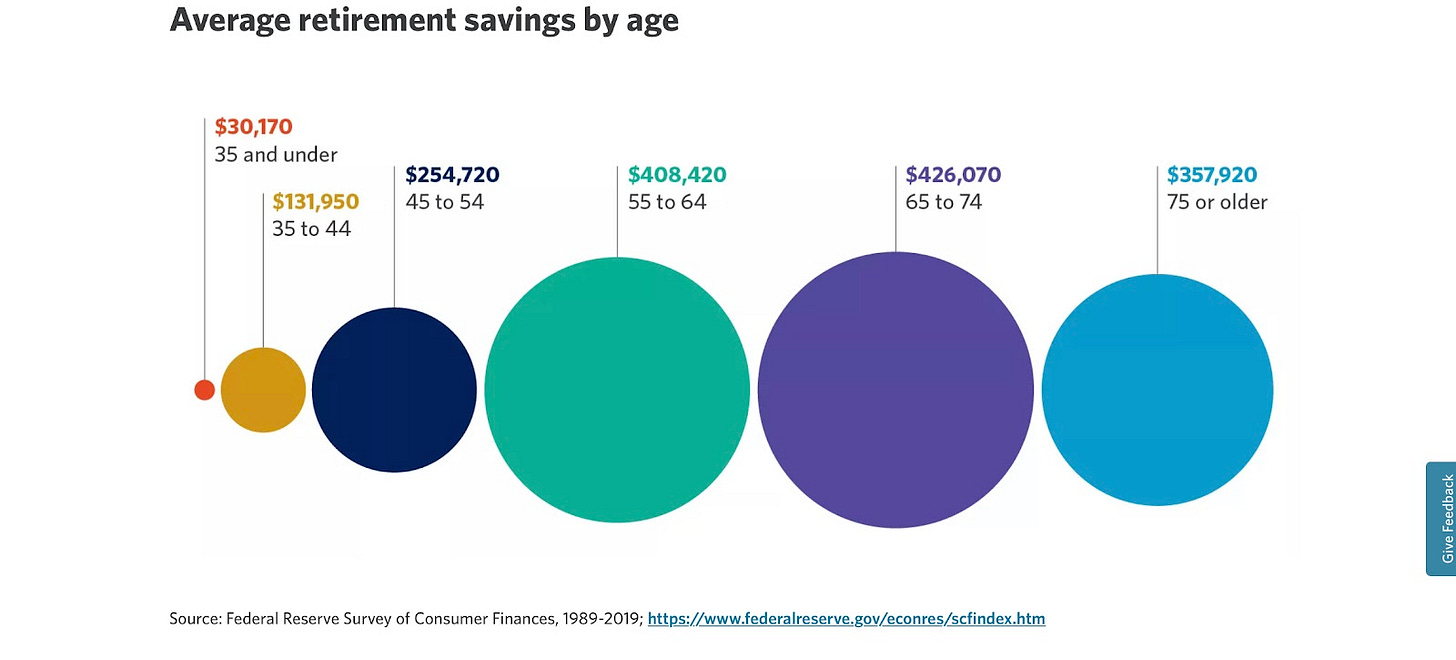

Source: https://www.edwardjones.com/us-en/market-news-insights/investor-education/investment-age/average-retirement-savings-age#:~:text=The%20above%20chart%20shows%20that,70%20have%20an%20average%20%24357%2C920.

Some tips to save for your child's college Education and your own retirement

Save money as early as possible; it's never too early or too late.

The notion of compound interest is one that every saver should understand.

Compound interest is what happens when the interest you earn on savings begins to earn interest on itself. As interest grows, it begins to accumulate more rapidly and builds at an exponential pace. - Cited from Securian Financial

The key phrase is, invest money to make money; that’s the important takeaway from all this.

A few tips I’ve personally used to help save for my kids and myself:

Set goals; if you plan for something then you are more likely to achieve it

Which schools do you want to send your kids to? (even though that may not happen, it's good to be prepared)

I aim to have two years saved up with the hopes the money will grow to cover all 4 years

I don’t know where my kids will go or if they’ll get scholarships or even go to school which is why I am only saving for 2 years

What age do you want to retire at?

Is it 62, 65, 67?

Do you want to live in your current state or move somewhere else?

What are you planning to do with your house? Keep? Downsize?

Max out your 401k every year; most companies offer a match. If the market returns on average 8-10%, well that could add up quickly

Pre-tax money will grow tax free until you are ready to withdraw in the distant future

Most states offer 529 plans, educate yourselves on how you can maximize those benefits

States offer up to 10k credit per child when you maximize these plans

I hope you find these tips helpful in your financial journey.

Please share your comments on tips you’ve found successful.