The Looming Recession: Can McDonald's do it again? $MCD

TLDR: Is McDonald’s an investment worthy, considering recession looms? With a history or resiliency, an older demographic, and convenience of current times, is it worth looking at as a safety play in your portfolio?

As I was watching the Super Bowl last month, one of the things I enjoy the most outside of the game are the commercials. Working in advertising and the media industry for a large part of my career, I’ve gained a lot of appreciation for the stories, production, messaging, and strategies by marketers. Especially on a big stage like the Super Bowl where prices for a :30 spot increase YoY.

One spot by McDonald’s had me intrigued and got me thinking. As we keep hearing about a recession that has gotten pushed back quarter after quarter but inevitably near. How does one combat and construct a balanced portfolio? What companies should you look at?

This led me down a path of looking at the consumer discretionary sector and household staples often used. When you think about it, one of the key aspects to investing is ‘invest in what you know.’ When times are rough and your dollar doesn’t go too far, where do consumers look?

McDonald’s, a company that seems to have withstood previous recessions has stood the test of time. Investors in the past have flocked towards it as a safe place. Where else can you stretch your dollar with a variety of options? The well known $1 menu meal of the past, happy meals, and combos that is.

We look at three time periods to get a better understanding of how McDonald’s has thrived. Is this a leading indicator of the time to come?

Recession: Early 2000s and the Dotcom bubble

During this time, while it was short lived, from start to finish $MCD saw decent 20% gains

Consumer products withstood the economic downturn during this brief time

Recession: Great Recession - December 2007 - June 2009

During the Great Recession from December 2007 - June 2009, the subprime mortgage crisis led to the economic downturn, McDonald’s seemed to have thrived. During this time, $MCD saw an increase of 46% in their stock value. Yes, even in tough times you can stretch your money to make you money.

Recession: COVID Recession March 2020 - April 2020

While brief, safe to say this recession was unlike others where the entire nation went into a lockdown period

Every company was impacted one way or another, $MCD’s included in one of them

This is a key time period we look at as this may start to represent what may happen after we get through this upcoming recession

During this recession, $MCD did not thrive, but what came after is worth a look

A 40% decrease during this time period led to a 125% increase after we emerged

With a run like we had with $MCD, is it worth a second look? A few things to consider prior to investing. What identified $MCD in the past may not resonate today.

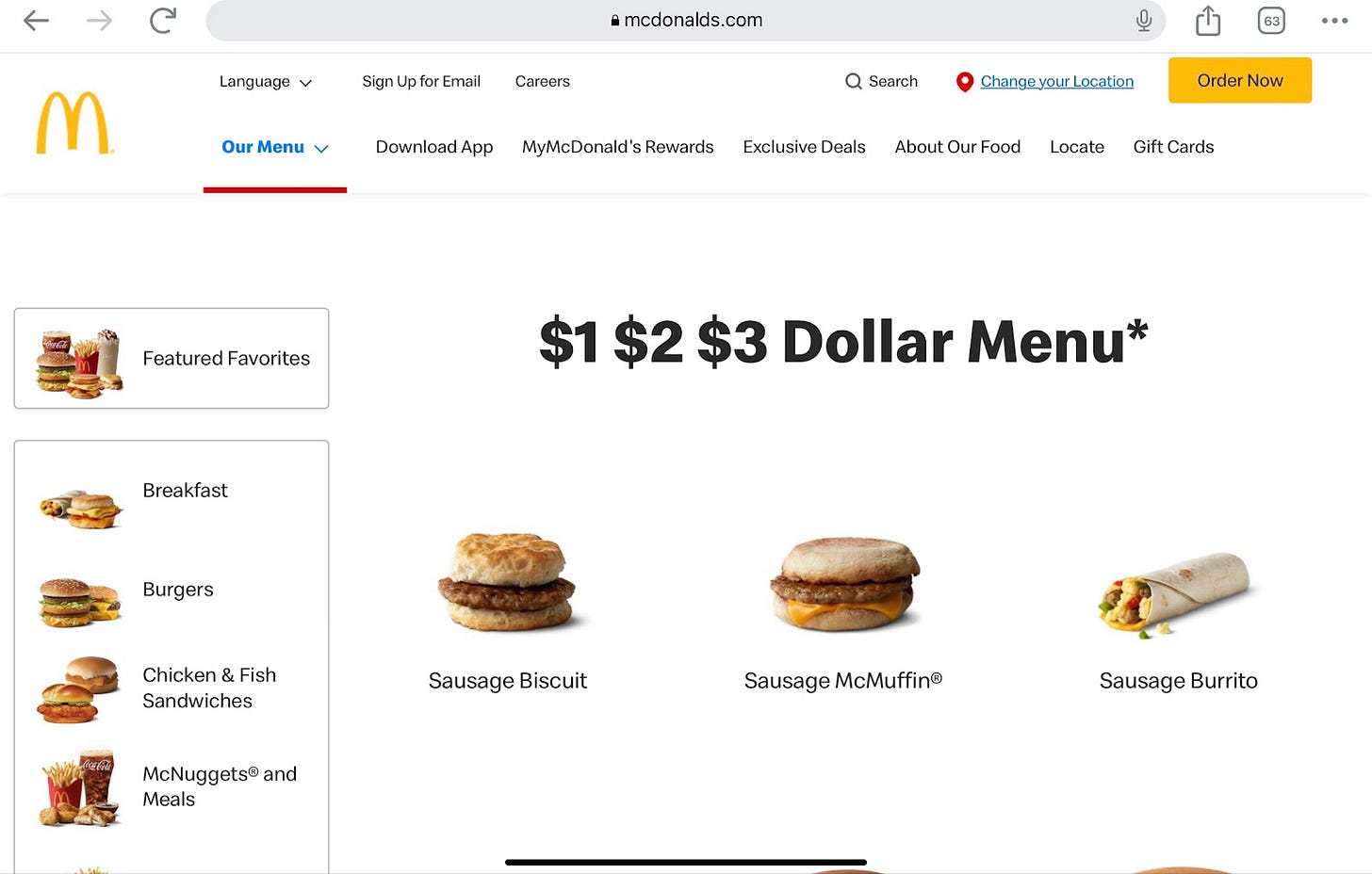

Dollar menu meal not a dollar any more

Growing up, the $1 menu was adequate and affordable, within reason

When you now go, it is no longer that and are presented with a variety of options

Options are good but it is not only a $1, we now have the $1, $2, $3 menu

Banking on the truths that brings you to McDonald’s

As I watched the Super Bowl and other advertising for $MCD, one thing for certain was how they are addressing their customers

There is more truth behind their messages

A recent advertising spot plays on a ‘couple’s truth.’ If you don’t know your partners’ McDonald’s go to order, do you really know them

This resonated with me and sure many others as I know what my significant other always gets and she knows what I always get

Checkout their commercial here:

Knowing Their Order (Extended) | McDonald's - YouTube

Aging demographics:

Face it, as we grew older, the happy meal wasn’t cutting it. We evolved and aged

It is rather smart the way McDonald’s approaches different need states consumers go through in choosing this fast food chain

I remember prior to going out on a Saturday night and in some cases after a night out, McDonald’s serves multiple purposes in our lives

McDonalds is now addressing the older demographic with comedic truths. McDonald’s as the adult hangover cure uses comedic truths because, we have all been there and shows a maturation of the brand for today’s customer

Automation:

With the advent of self ordering kiosks, McDonald’s as well as other fast food chains now use these kiosks to automate customer orders and reduce overall overhead. Less need for workers

Putting the order in the hands of the customer with the McDonald’s app eases the antiquated drive through process as well as having gig economy workers deliver your order further reducing order friction

So with an upcoming recession, does it make sense to add McDonald’s to your portfolio? At the moment we suggest waiting.

With 100%+ returns over the last few years, it is best to let the price cool down a bit. While many of these features provide a sound future and potential growth with previous recessionary times proving it to hold well; we must keep in mind today’s consumer has an abundant amount of options. McDonald’s isn’t the only fast food chain with these features and advertising messaging strategy.

Conclusion:

It is also going to be the first recession for many. Your $1, $2, or $3 has a lot more completion and with habits formed from staying at home, $MCD investors should wait to get in. Additionally with its fast run up over the last few years, you don’t want to be caught buying at the top. $MCD can perform with profitable gains, but we need to see how much the recession impacts us. Remember, unemployment is still an issue so saving now is more crucial than ever.

If you’re enjoying our content, please share with your friends, comment below and subscribe.

If you’d like us to cover any specific topics, please an email to info@2dadsfinance.com for consideration.