Week of February 13th, 2023

As we head into the 2nd week of February, it has been difficult to ignore all the buzz about the recession, down turn in the housing market coupled with news of layoffs across the board. Given all those headwinds, we don’t see demand cooling — perhaps that is a result of where live in the Northeast. (Let us know in the comments if you see otherwise.)

Perhaps things will slowdown in the coming weeks, months, but today Ravi and I don’t really much slowing down here in Northeast. Looking at today and into the coming weeks, our plan is to not make any change to our portfolio’s but focus on a few small stocks to help build capital until we have a better sense of what’s going on, or might happen.

If you heard the state of the union, you might have heard Biden call out big oil companies for their insane profits. For that reason, we are focusing our attention to build some capital through calculated moves with options trading across Exxon Mobil and Nvidia (A Pelosi favorite)

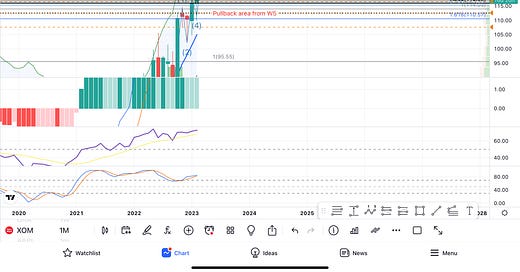

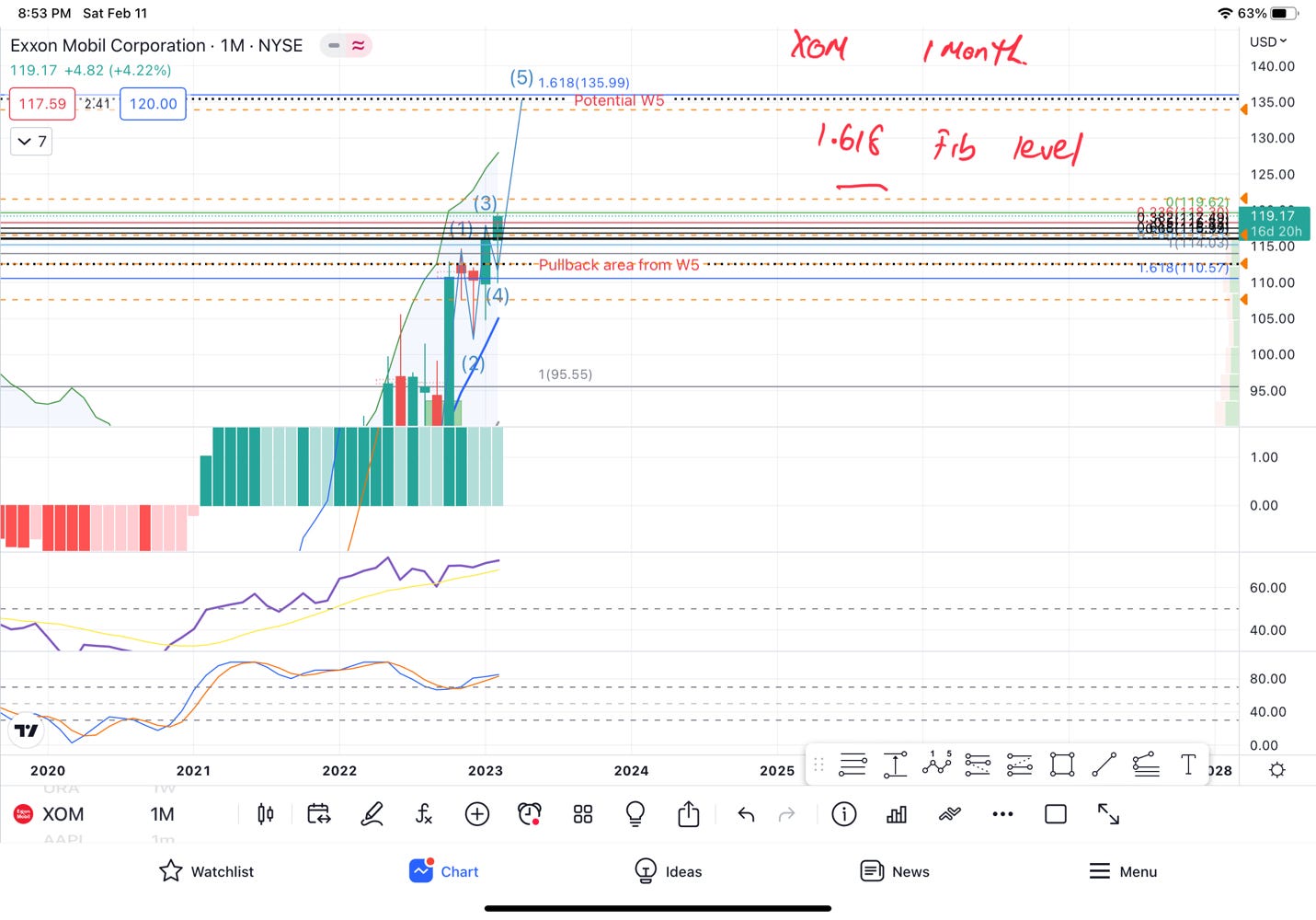

XOM: Exxon Mobil

Big move by oil Friday.

Expect a pullback to 116 (based on fib pullback levels)

Moving averages are curling back up

In the middle of Wave 5

RSI and Stochs are increasing

Monthly chart shows golden fib level at 1.618 where W5 is calculated to end

XOM Game plan:

Rule: Every strong move deserves to be retested - Simply put if something goes up, it must come back down to a similar area and vice versa. That’s one way of charts telling re-affirming a direction of a stock or the overall market.

Pending Monday open 2/17 116P (high volume/low OI)

Rule: Wave 5 completion

Once it hits 116, let it settle, and evaluate 3/17 135C for a swing play (lower vol, higher OI) Rule:

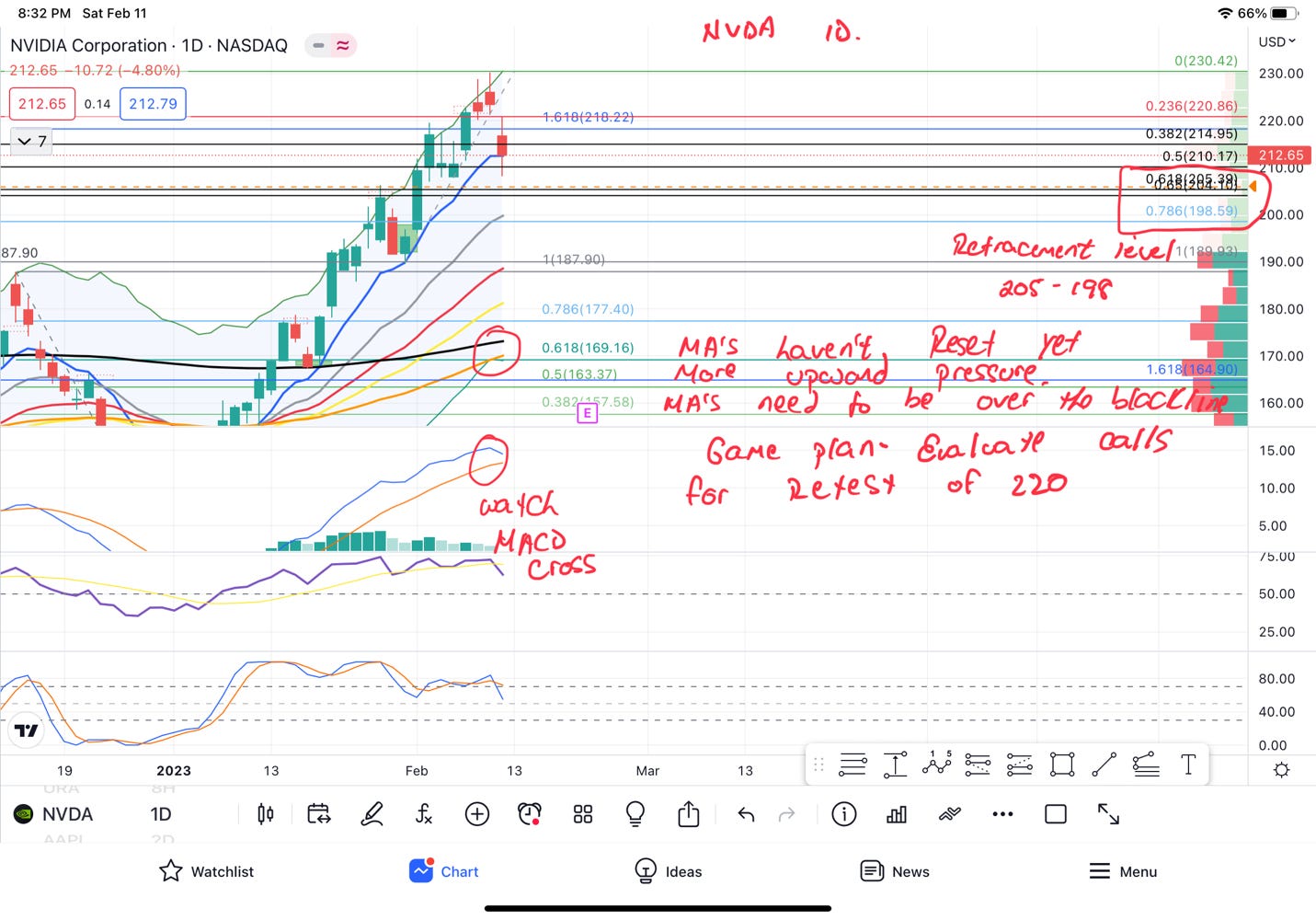

NVDA:

NVDA finally broke down, however expecting a retracement to price levels from last week

Retracement area 205 then popping back up to retrace the red candles made last few trading days

Retracement of 230

One more moving average needs to be reset over the black 200dma line

Potential for 2/17 230C – big catalyst will be CPI if retracement to 230 does not occur before Tuesday

Premiums on anything with a closer strike for 2/17 Calls

Another possibility is to wait for the retest to 230 then a swing play for March puts (this is probably a better play, dealing with less premiums, strike price tbd)

If you understood all this, then you’re ahead of the curve, but if you didn’t that’s okay — we are here to teach you.

What’s important above

We don’t really know what’s going to happen in a few weeks or months — will Recession be a thing? Maybe

Right now - we see an opportunity to make some calculated bets using charts and overall macro trends on Exxon Mobile and Nvidia

We see large move potentially happening — if you’re a holder consider adding these alerts to see if they play out

Similar story with Nvidia — we see potential large movements which could give us a clue into the broader market and how to play the next quarter or two

All this could change on Tuesday when CPI data is released

This is simply an inflation tracker - are things getting more expensive or starting to get cheaper?

This indicator usually is a good way to understand where we are going the next few weeks

Thank you again for taking the team to read our thoughts for this week.

Please subscribe

Please share

Leave any comments