What are Options: The Risk and Reward Behind Them:

TLDR: Curious about options? We will review what options are, how they can be used and how you add options to your portfolio

So what Are Options? We got this request from one of our readers and have come across this question often. There is a lot of confusion when it comes down to what they are, how to use them, and why use them at all over just investing in stocks?

Why use options?

Most of us own stocks or are exposed to stocks through our 401k, or some ETF’s we own

All those are typically buy now and sell at some point in the future with the hopes of that asset being higher in price. What do you do now when things are starting to go down due to inflation worries? Hedge - bet the opposite way to protect gains.

For example, you bought Apple for $100 a few years ago, and now you’re starting to see the price come down. You can hedge by buying a put option at $100 strike, which protects your gains for a small amount of money

Income generation is a second use case for options where you sell the right to buy shares you own to someone else where you collect a premium for that. We don’t dive into that much since it a bit more complicated topic and best to consult a Financial Advisor

Speculation, or betting a stock will do something; go up, go down, or stay where it is

Building on our previous articles regarding NVDA and TSLA, those stocks went up, so you’d want to buy call options.

One share of is about $230, where one option might be $300-$1,000 but you’re also controlling 100 shares vs 1

What Are Options?

According to Investopedia: Options contracts give buyers the right, but not the obligation, to buy or sell an underlying asset (stock) at an agreed upon price and date

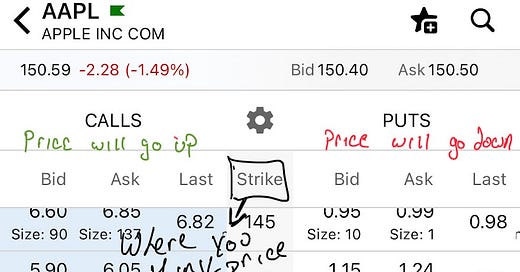

Main components of options:

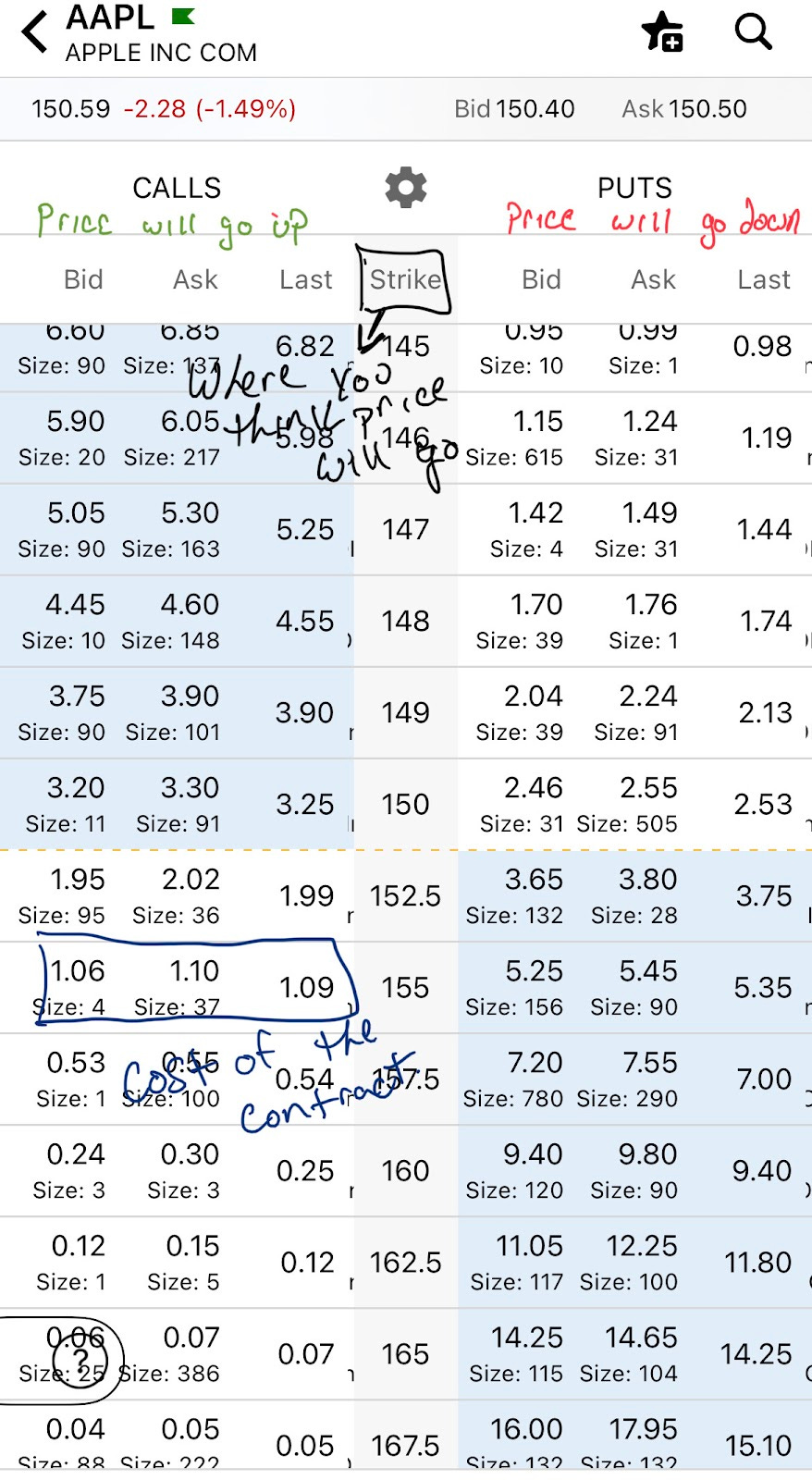

Time: When the options contract will expire

Strike: Where you think the stock price will go by the expiration date

Puts: Belief that the price in the underlying asset (stock) will go down by the expiration date

Calls: Belief that the price in the underlying asset (stock) will go up by the expiration date

Price: Amount you pay for those contracts; represented as a dollar X 100 =. Your cost.

Watch outs:

As each day passes and the exploration date gets closer, the value of your contract will decay.

eg. Apple sits at 150.59; needs to get to $155 before 3/17; each day that $1.09 is no longer that value and can be down as much as 80%

If trading options, time is ticking and value is lost. Unlike stocks where you buy shares and can hold onto them until you sell.

You can buy Apple today for example and sell it in 20 years when the value has increased. You simply cannot just hold onto options contracts because of the strike price, when the contract expires.

Options are risky!

On the other hand, options are also rewarding.

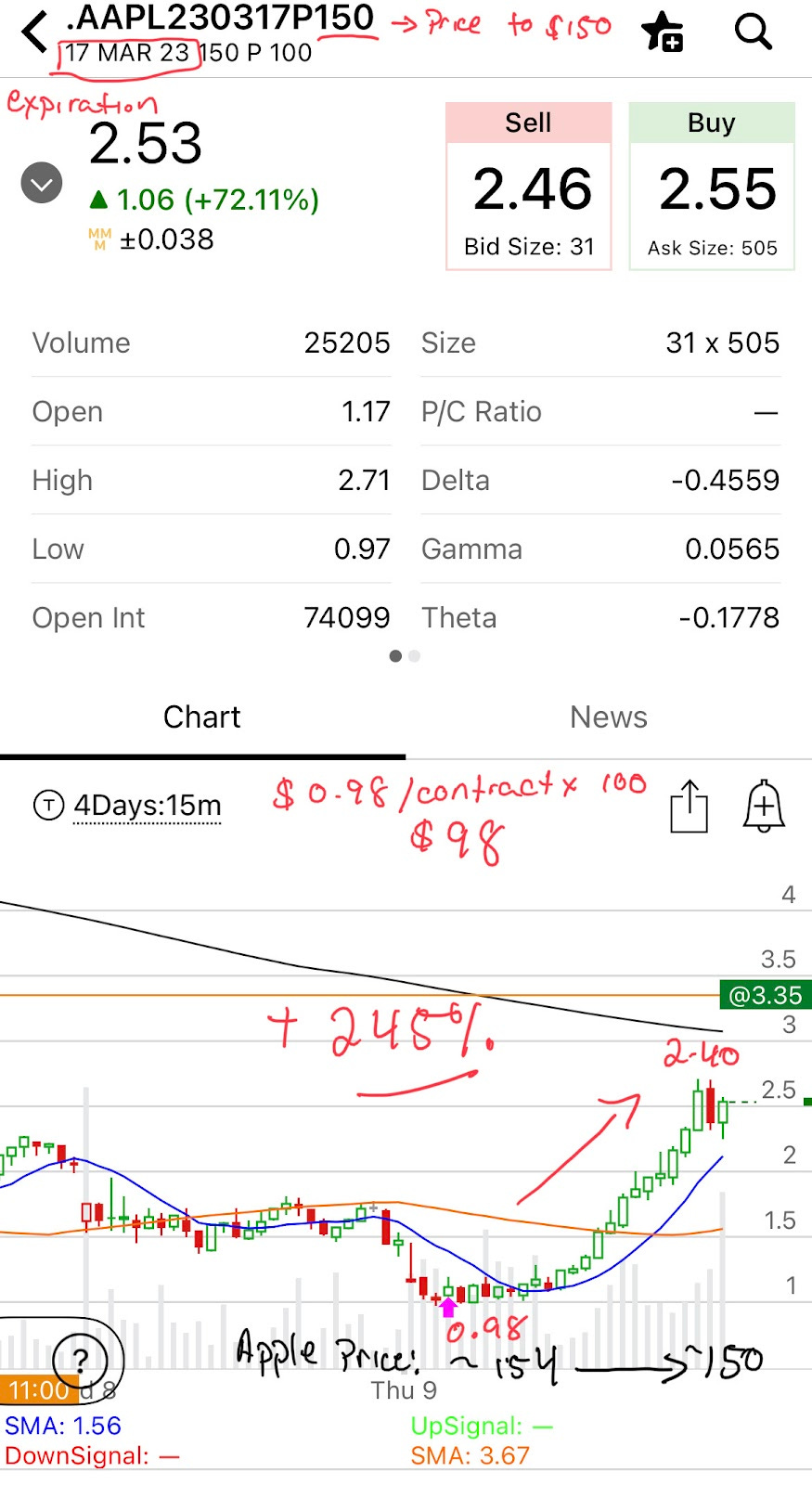

Here is an example of a trade we recently participated in. We entered when Apple’s price was ~$154 believing the price will go down. Price went to $150. The yield from bottom to high was ~245%. So your investment, in a single day, would be up that much.

This can happen and does, but it is about balancing risk and reward.

There is a lot more that goes into options. If you like this type of content and want to hear more, please let us know. We enjoy hearing from you!

We are 2 Dad’s just sharing our knowledge. We are not Financial Advisors or certified in any way; just sharing our experiences with you.