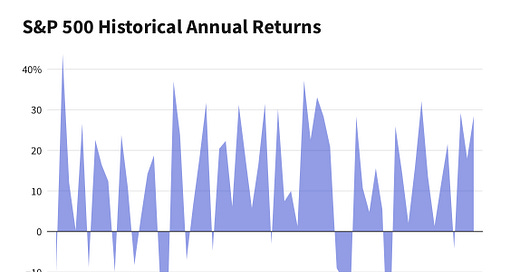

If you’re a saver and have been looking for ways to save money other than investing in the stock market, then researching Certificate Deposit’s (CD) are a good option. For some, they may not want to take the potential risk associated with investing in stocks and the volatility it may bring. CD’s provide a guaranteed return vs. a fluctuating one. The return in the S&P 500 over the last 65 years has yielded an average of 10.18%, but does bring years of uncertainty.

Certificate of deposit (CD) rates have been hovering around historic lows for nearly 10 years, leaving many savers searching for ways to make their money work harder. Over the past year or so, the Federal Reserve has been raising interest rates to fight inflation, inturn which is a great thing for savers (not so much for home buyers)

It's important to understand what a CD is. A CD is a type of savings account that offers a higher interest rate than a regular savings account in exchange for locking in your money for a specific period of time. CD durations could be a few months, a year, or 5 years; it all depends on what you’re looking for and how comfortable you are with locking your funds for that specific period.

There are 5 key reasons we identify why you should care about a 5% CD today.

They can provide a guaranteed return on investment. Unlike other investment options such as stocks or mutual funds, CDs are FDIC insured up to $250,000 per depositor, making them a low-risk investment option. This means that even if the bank or credit union goes out of business, your principal and accrued interest will be protected.

If you’re looking for yield, you are now earning 5% risk-free, which means other riskier investments need to return a yield greater than 5% to have a meaningful return for investors. If you’re a real estate investor, a crypto investor, a stock investor, you might now expect to return 15-20, or more given the risk free rate is now hovering around 5% (give or take depending on your banks and duration). How likely are you to see those higher returns given the inflationary times we are in?

They offer a predictable source of income. Since the interest rate is fixed, you know exactly how much you will earn over the CD's term. This can be especially appealing for retirees or those on a fixed income who rely on interest income to meet their living expenses or anyone looking to diversify their portfolio a bit by reducing their exposure to risk.

It be a smart choice for those who have a specific savings goal in mind, such as buying a new car or putting a down payment on a home. By choosing a CD with a term that matches your goal's timeline, you can earn more interest on your savings than you would with a traditional savings account.

Finally, 5% CD rates can help combat inflation. Inflation erodes the purchasing power of your money over time, meaning that if your savings don't keep up with inflation, you may end up with less buying power in the future. By earning a higher interest rate, you can keep pace with inflation and ensure that your savings maintain their value over time.

A CD is a great financial mechanism to diversify your overall portfolio or even stash some cash away risk free for a more novice investor. The goal for your money is to make your money.

I like the point about using CDs as a savings vehicle for specific purchase goals. Locking their money for 5 years would help the consumer practice financial discipline.